Become a homeowner without equity

The cost of becoming a homeowner for the first time has risen to levels that make it virtually impossible for younger generations to keep up with. However, as the cost of homeownership sprawls around the world, fintechs and blockchain technology are combining to offer opportunities to younger buyers that traditional mortgage brokers are unable to provide.

For many of us, owning our own home has become a right of passage — our just reward for working hard to achieve our dreams. However, over recent decades, it’s become virtually impossible for younger generations to accumulate the finance they need to buy their first home.

With house prices rising at an alarming rate in comparison to wages and the gulf between rental costs and income expanding too, there’s simply no way that generation Y and Z alike can earn their way to a home of their own without help from friends and family.

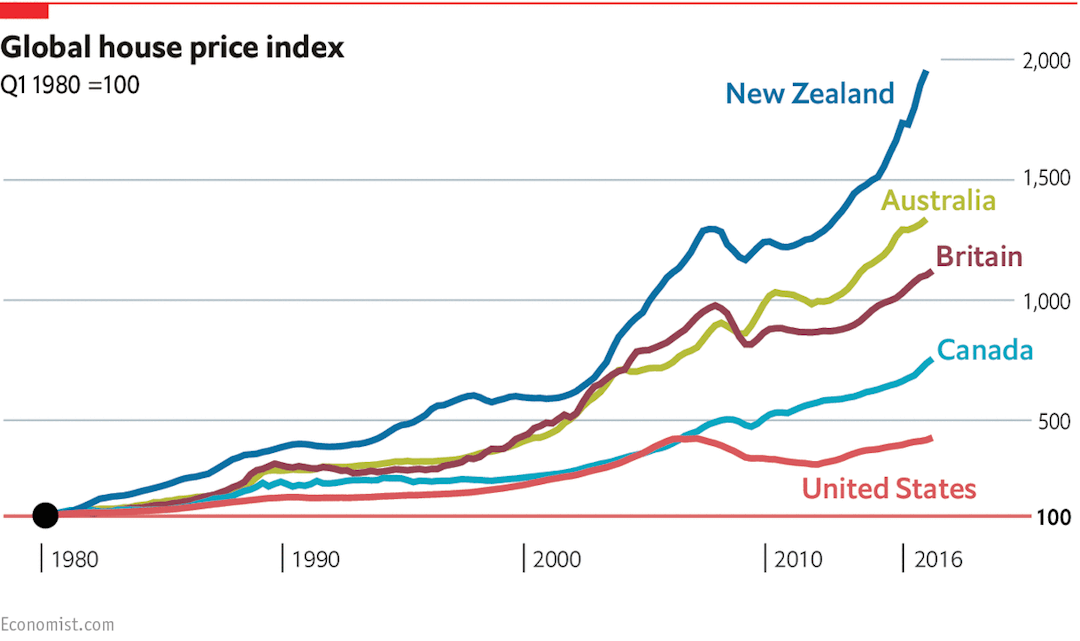

Global house Price Index

(Image: The Economist)

As the chart above shows, house prices have been accelerating at an unsustainable rate across the globe in line with wages since the 1980s. While property prices in the United States have grown at a rate of almost 500% over the past 40 years, other nations like Britain and Australia have seen over 1,000% price increases. New Zealand possesses the runaway fastest appreciating housing market, reaching 2,000% growth.

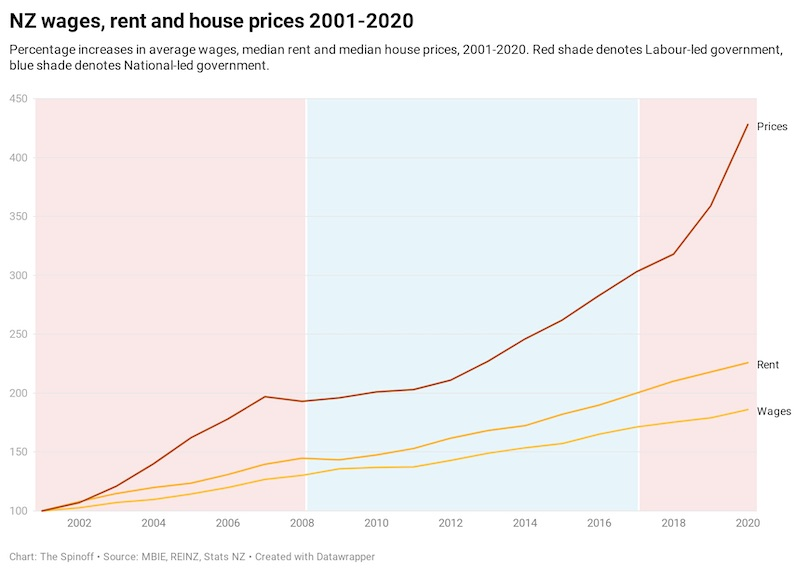

NZ Wages, rent and house prices 2001-2020

(Image: The Spinoff)

It’s the case of New Zealand’s property market that shows us just how much of an impossible task younger generations have in getting themselves on the property ladder. As we can see from the chart, since the beginning of the 21st Century, wages have climbed almost 200%. This is a rate of growth that’s outstripped by rent, which has grown by 225% — however, both are dwarfed by the sprawling housing market, which has seen price increases of some 425%.

This means that generation Y must risk falling into a sea of debt as they attempt to keep up with the growing housing market. With rental costs climbing at a considerably faster pace also, it leaves employees having to work significantly harder simply to pay rent and accumulate enough money to save for a mortgage at the same time.

The data above suggests that it’s virtually impossible for individuals to save the money they need to buy their first home when considering existing traditional financial structures and our reliance on mortgages as an avenue to homeownership. However, with the help of blockchain technology, ReTok offers an equity-free solution that’s in-tune with the future of finance.

Mortgage-free homeownership

ReTok allows renters to purchase shares of their home on a month-by-month basis, all without existing equity and no risk of defaulting. With ReTok, there are no mortgages, so there’s no debt attached to the prospect of homeownership — you’re simply free to purchase as much or as little equity in your home as your monthly income allows.

The revolutionary methodology behind ReTok has been made possible by recent developments in fintech. The purchased equity in homes is held by the buyer as tokens that are tradeable on a marketplace that’s powered by the Avalanche blockchain.

This means that your equity can easily be liquidated into cash at any time — unlike the case with mortgages. Have unforeseen expenses meant that you need a little extra cash before payday? Are you looking to take out some of your equity to make a one off purchase? ReTok offers the simplest and most flexible solution in saving for a home in a way that suits you.

In traditional approaches to mortgage financing, some buyers are forced to sell the homes that they love in order to recover lost income or generate large amounts of money at short notice. With ReTok, you can sell only the shares you need and buy them back when your financial situation picks up again.

Built by blockchain

ReTok’s housing revolution is built on the Avalanche blockchain, which hosts a vibrant marketplace in which buyers can use their tokens to buy equity in the properties that they love.

Avalanche stands as one of the world’s fastest and most secure open-source blockchain platforms for new financial primitives and decentralized applications (DApps). The platform was created to address some of the shortcomings of older blockchains in terms of transaction speeds, centralization and scalability. Avalanche’s consensus protocol, which offers low latency, high throughput capabilities and 51% attack resistance, makes it the ideal host for ReTok’s reimagining of homeownership.

In a world that’s become accustomed to seeing rapidly rising house prices and little in the way of wage growth to keep up, it’s clear that traditional mortgages are no longer fit for purpose for many younger individuals who dream of owning their own property.

With ReTok, it’s possible to purchase your dream home in a sustainable way that ensures you’ll never be left high and dry during an expensive month and that you’ll no longer have to risk running yourself into the ground just to get onto the property ladder. Welcome to the future of homeownership.