How security tokens can increase your wealth

The cryptocurrency landscape has become a sprawling place in recent months, with high volumes of new investment arriving and institutional acceptance making the use of crypto far more commonplace. The rise of cryptocurrencies like Bitcoin and Ethereum has also paved the way for the emergence of security tokens, but it’s vital to acknowledge that there are significant differences between these asset-backed securities and the coins you can buy on exchanges.

ReTok has established a blockchain-based token that enables individuals to invest in residential real estate through the purchase of ReTok tokens. With one token, you own a share of a portfolio of properties carefully selected by the company’s committee of experts who use AI to power their decisions. As the value of the properties in the portfolio rises, so too does your investment. But how do security tokens make this possible? And why are they so different to the rest of the cryptocurrency ecosystem? Let’s take a deeper look into the tokens that power ReTok.

A utility token gives you a "piece of the pie"

Defining security tokens

Fundamentally, security tokens are a representation of a security. This means that the value of the token is defined by the value of the security that they represent. By holding security tokens, you can have your investments pegged to tangible, real-world assets to ensure more stability than what we’ve become accustomed to seeing across the wider cryptocurrency markets — all whilst still enjoying the benefits of safe and secure distributed blockchain technology.

If your tokens are stolen or lost, they can be replaced by the issuer, making them far safer to possess than traditional cryptocurrencies. Asset-backed security tokens also make for frictionless trading and no brokerage fees attached to the investments you make — paving the way for greater levels of profits from the appreciating value of your portfolio. There’s also no underwriting fees attached, which again helps your bottom line significantly when maximizing the potential of your investments.

Because ReTok tokens are attached to the value of the real estate that they represent, it means that your investment will be safe as houses — literally. As the housing market continues to climb, so will your investment. In buying ReTok’s security token, you can tap into the investment-grade security offered by blockchain whilst being safe in the knowledge that as long as the residential real estate market remains stable, you’ll have a portfolio that’s safe from the highly speculative cryptocurrency market.

However, it’s also vital to acknowledge the drawbacks of security tokens. Today, the regulatory climate surrounding cryptocurrency and asset-backed security tokens remains unclear — although it’s worth noting that regulations surrounding the industry are generally improving. ReTok took the wider regulatory outlook into consideration when devising its business model, and identified Switzerland as an ideal environment for both entrepreneurs and investors to prosper using its security token.

The differences between cryptocurrency and security tokens

The cryptocurrency market can be a complex place and the blockchain technology that it’s built on offers a wide range of exciting opportunities in terms of the smart contracts and advanced financial services that can be built using its framework.

So why is ReTok’s security token nothing like Bitcoin? Well, cryptocurrency coins like BTC and ETH are assets that are built on their native blockchain, whereas tokens — like security and utility tokens — are assets that are foreign to the blockchain they live on. So, whilst Bitcoin and Ethereum use their own blockchains, stablecoins like Tether act as a second-layer token across multiple blockchains. Likewise, popular tokens like Uniswap and Chainlink use Ethereum’s blockchain — as do many more assets owing to the popularity and quality of this particular blockchain.

In such a rich and varied digital finance ecosystem, it can be difficult to define how emerging technologies perform different roles, but writing for CoinDesk, Janine Yorio delivered a strong analogy. “Utility tokens are like chips in a casino,” Yorio explains. “They can be used as currency within the casino for playing games and tipping dealers, and converted back to fiat/cash when it’s time to cash out. Holders of a casino’s chips do not own a stake in the casino, nor are they entitled to any of the casino’s winnings or profits.”

“Security tokens, on the other hand, are like owning stock in the casino, shares in the company itself. When the house wins, you win. Security token holders own something that might pay off through profits or distributions. Utility tokens are used in an ecosystem. Security tokens give you ownership in that ecosystem.”

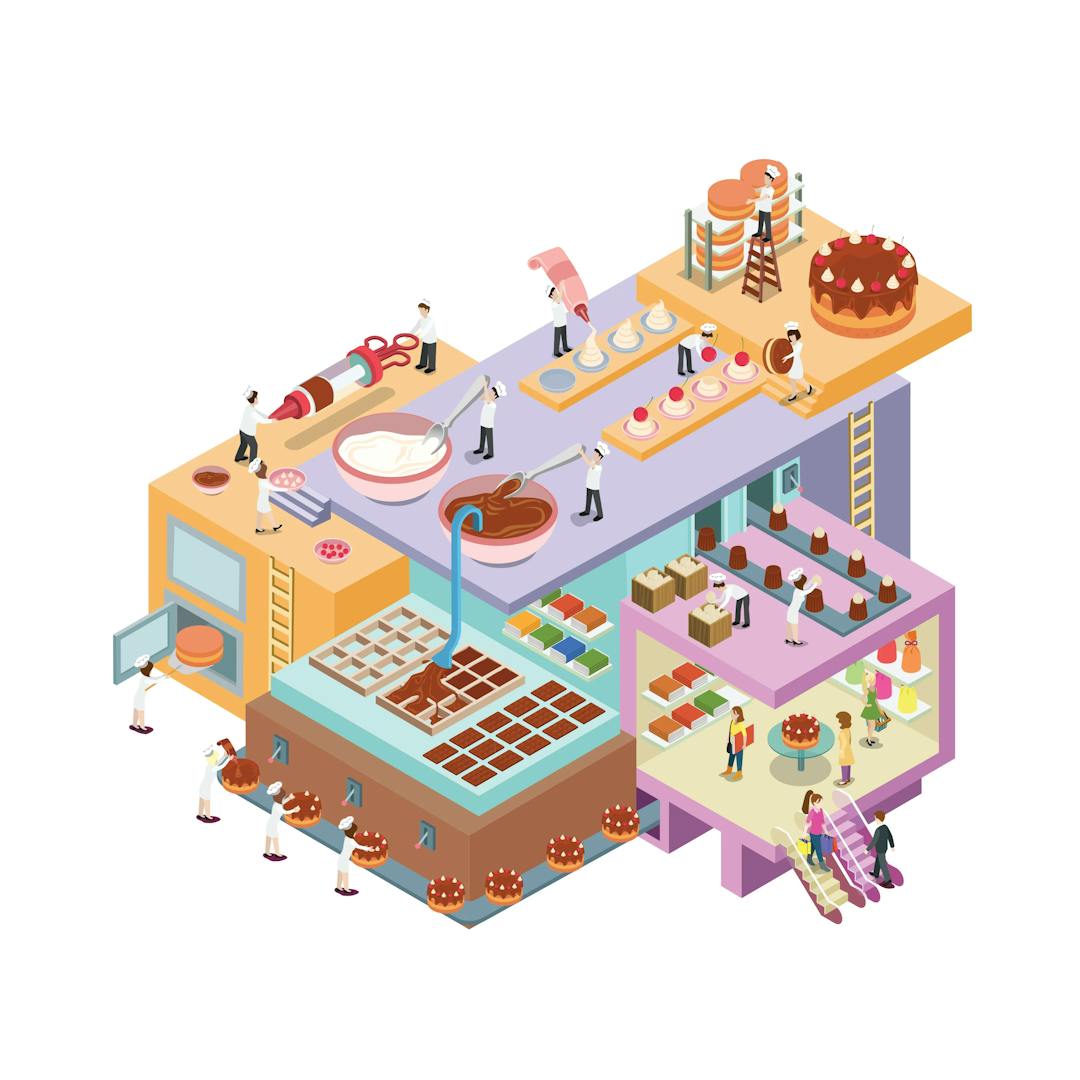

A security token gives you a share in the cake factory.

It’s through the use of security tokens that investors can use cryptocurrency to really take control of their investment options. It represents far less of a gamble than betting on the appreciation of crypto assets, and evidence suggests that, in some part of the world at least, regulatory hurdles are beginning to disappear.

Over the past two years, the SEC has registered a number of securities tokens for use — including an $85 million security token offering from INX in September 2020. Although there’s a long way to go to win over regulators, these small steps towards acceptance mark a significant transition for the industry as it progresses away from its volatile past and towards a new era of compliance.

In asset-backed securities, we can see a perfect blend of advanced blockchain technology combining with tangible assets, such as real estate in the case of ReTok, to deliver growth for investors in an effective way.

Retok offers tokenized shares of portfolios of residential properties. Sign up now if you are interested in getting your first tokens.