Real estate investment = easy money?

Is it really that simple?

Buy an apartment, get a tenant to rent it, then watch the money come in. Investing in real estate looks dead simple, like a sure way to fructify your hard earned savings. If it sounds too good to be true, it’s because it is.

It’s February 15th, you’re standing in line for the ski lift under a blue sky, looking forward to finally enjoy some outdoor winter fun after all these months of travel restrictions. When you finally get to the front of the line, your cellphone rings. You scramble to reach it before it rings out, removing your gloves to frantically open every pocket in search of the damn device.

You finally find the pestering device inside the innermost pocket of your hi-tech ski jacket, just when the caller lost patience and gave up. A message on whatsapp pops up on the screen, while people shout abuse at you for jamming up the line. Stepping aside, you read the message. It’s from your tenant: “CALL ME URGENTLY!!!!”. You comply anxiously and get more shouting from the other end: your tenant, angry and cold, inform you that the heater broke down. You try to calm him down, assuring him that you’ll take care of it as soon as possible. It does nothing to sooth his anger as he’s already talking about lawsuits, damages and rent withholding.

This scenario could sound caricatural but is actually very realistic. It happened to Jonathan, a close friend of yours truly.

Managing a rented property is a lot of work: finding tenants, screening tenants, contracting with tenants, handling common maintenance, handling contractors, handling issues related to the commons of a multi-owner building, tax accounting, …

Managing a portfolio of rented property is a whole other story. In addition to property management, it involves considering the properties as assets and managing them to maximize the returns to investors.

Asset management involves taking decisions during the full lifetime of the portfolio:

- Properties offering the best potential for return have to be scouted, often off-market through a dedicated network.

- Once part of the portfolio, the potential of each property has to be constantly re-evaluated. According to the evaluation, a decision to sell the property to buy another one with better potential could be made.

- An independent third party has to be hired several times a year to appraise all the properties of the portfolio. The appraised value is used by the assets manager to guide their decision. The value is also published so that investors can rationally price the portfolio.

- As with ReTok the properties can be part-owned by the tenants, the asset managers have the added job of deciding the price and the amount of shares to make available for sale to, or to offer to buy from the tenant

- The size of the cash reserve has to be skillfully managed. As cash doesn’t provide returns, it must be kept at a strict minimum, while being sufficient to cover the expected future cash outflows (shares repurchase, renovation, legally mandated building improvements, …)

Investing in real estate is an involved process on the long run. You can do it yourself and build a portfolio of properties if you have the skills, resources and the will to do it.

Or you can out-source management to professional through indirect investment. A variety of product exists so you should be able to find the one matching your investment strategy. For instance, there are ETFs providing a passive exposure to a real estate index in a given market.

ReTok offers tokenized shares of actively, professionally managed portfolios of residential real estate. Active management helped by the innovative tenant-owner concept aims to beat the benchmark of the real estate price index.

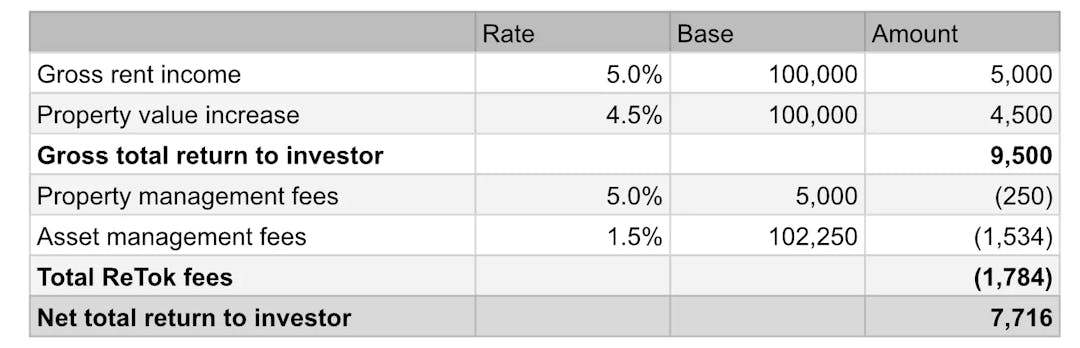

Compensation for services provided is transparent and straightforward. It’s inline with the common practice of the industry:

- Active asset management is covered by a 1.5% annual fee on the average net assets value of the portfolio over the past year.

- Property management is covered by a 5% fee of gross collected rents.

Let’s illustrate with an hypothetical example:

An investor gets EUR 100'000 of shares in a portfolio where rent yield is 5% and annual property value increase is 4.5%. Here’s his account statement at the end of the first year:

Account statement